Maturity value compound interest calculator

The formula can be used to calculate the reverse interest rate when one has maturity value to know the true rate of interest earned on the investment as we did in our last example. Note here that in case you make a deposit in a bank eg put money in your saving account from a financial perspective it means that you.

Compound Interest Excel Formula With Regular Deposits In 2022 Excel Formula Compound Interest Excel

Secondly in the case of compound interest investors will also have to look at the frequency of the compounding because the frequency of compounding has a direct impact on the maturity value.

. Annual Interest Payment Face Value - Current Price Years to Maturity Face Value Current Price 2 Lets solve that for the problem we pose by default in the calculator. The maturity value formula is V P x 1 rn. Treasury savings bonds pay out interest each year based on their interest rate and current value.

Compound interest will result in higher maturity value than simple interest rate if the rate of interest is the same. Bond Face ValuePar Value - Par or face value is the amount a bondholder will get back when a bond matures. CI 13449 10000 Rs.

This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value coupon rate market rate interest payments per year and years-to-maturity. Call Mon to Sat from 10 am to 7 pm STD charges apply. For example when an investor starts their RD in the month of February the amount will earn only simple interest until the month of March.

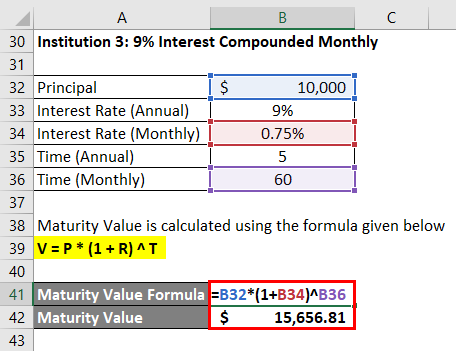

Simple Interest on Fixed Deposit. You can learn more about Excel Modeling from the following articles Compound Interest Examples Compound Interest Examples To calculate the compound interest in excel the user can use the FV function and return the future value of an investment. Using the Bond Price Calculator Inputs to the Bond Value Tool.

Compound Interest is calculated on the principal amount and also on the interest of previous periods. Term deposits earn very similar interest rates to savings accounts and are heavily tied to the cash rate. In finance interest rate is defined as the amount that is charged by a lender to a borrower for the use of assetsThus we can say that for the borrower the interest rate is the cost of debt and for the lender it is the rate of return.

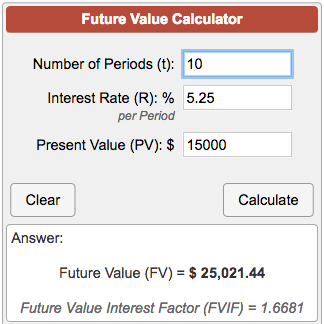

Compound Interest Explanation. Our calculator provides a simple solution to address that difficulty. Future value FV is a measure of how much a series of regular payments will be worth at some point in the future given a specified interest rate.

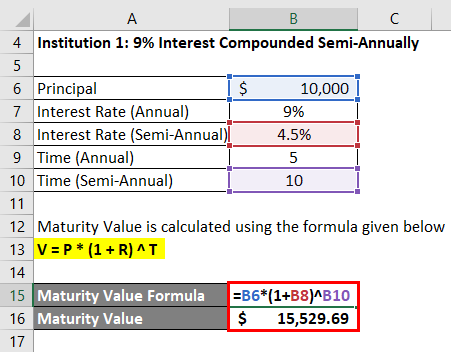

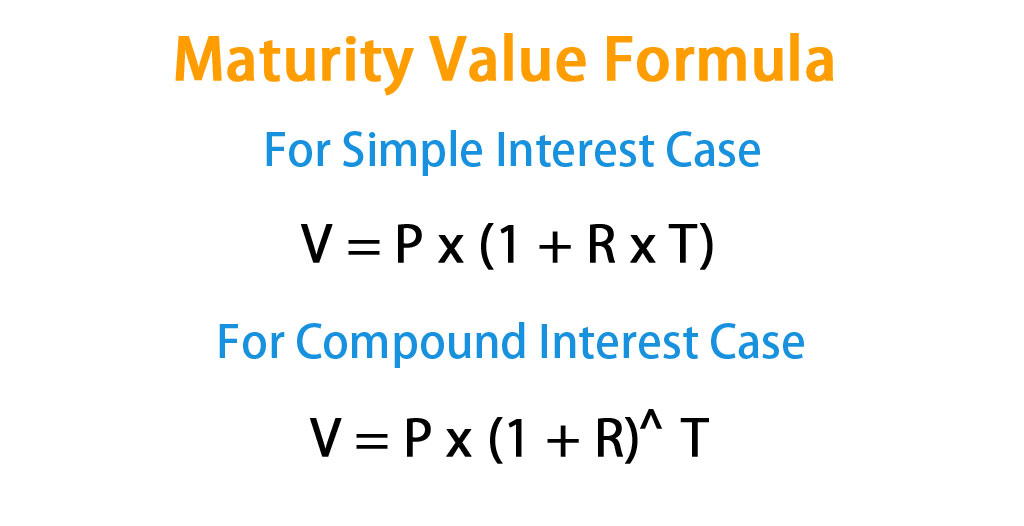

The calculation of compound interest can involve complicated formulas. You see that V P r and n are variables in the formula. Maturity Value Principal amount Simple Interest Rs 100000 Rs 50000.

However they use the same FD formula for arriving at maturity value of fixed deposits In India banks use quarterly compound interest calculator in rupees. Search for a reputable site. A t A 0 1 r n.

Calculate interest compounding annually for year one. Based on quarterly compounding M R1in 11-1i -13 Where M Maturity value of the RD. Lastly the interest on fixed deposit can be calculated by two methods simple interest and compound interest.

The formula for the approximate yield to maturity on a bond is. Banks use the following formula for RD interest calculation in India or the maturity value of RD. Given Australias record-low cash rate youll struggle to find a term deposit paying over 200 pa.

If you own a money market fund for example type in money market fund maturity value calculator. Here we also provide a Simple Interest Calculator with a downloadable excel template. V is the maturity value P is the original principal amount and n is the number of compounding intervals from the time of issue to maturity date.

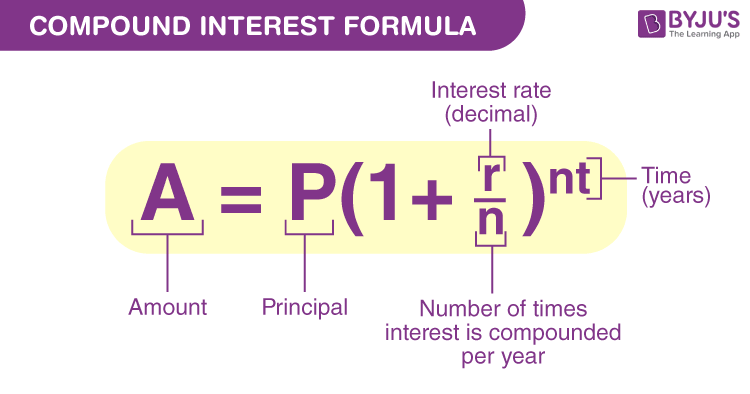

Assume that you own a 1000 6 savings bond issued by the US Treasury. Where A final amount including interest P principal amount r annual interest rate as decimal n number of compounds per year t number of. Term deposit interest rates are fixed but they tend to vary depending on the term you choose thats how long you deposit your money for.

Interest paid in year 1 would be 60 1000 multiplied by 6 60. However those who want a deeper understanding of how the calculations work can refer to the formulas below. Plus the calculated results will show the step-by-step solution to the bond valuation formula as well as a chart showing the present values of the par.

MR1i n-11-1i-13 Where M Maturity value. To calculate the maturity value of an RD the following formula is used. So for example if you plan to invest a certain.

For Existing Customers Issued Policy Whatsapp 91 8291-890-569. As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate compounded. The quality and usability of each online calculator tool can vary greatly.

Most banks that offer recurring deposits compound the interest on a quarterly basis. Compound Interest CI Earned over 3 years Maturity Amount Principal Amount. The variable r represents that periodic interest rate.

Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. Maturity value of RD. Find out the initial principal amount that is required to be invested.

However in case you wish to calculate compounding on other basis say monthly half yearly or annual basis. In reverse this is the amount the bond pays per year divided by the par value. Only after the first quarter the interest starts compounding.

Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. Call Mon to Sat from 10 am to 7 pm Local charges apply 1860-267-9999. Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and.

The following formula can be used to find out the compound interest. Use two different calculators to validate your. In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result.

You can use Scripboxs simple and easy-to-use online calculator to estimate the maturity of FD. The detailed explanation of the arguments can be found in the Excel FV function tutorial. For example if a sum of Rs 10000 is invested for 3 years at 10 compound interest rate quarterly compounding then at the time of maturity A.

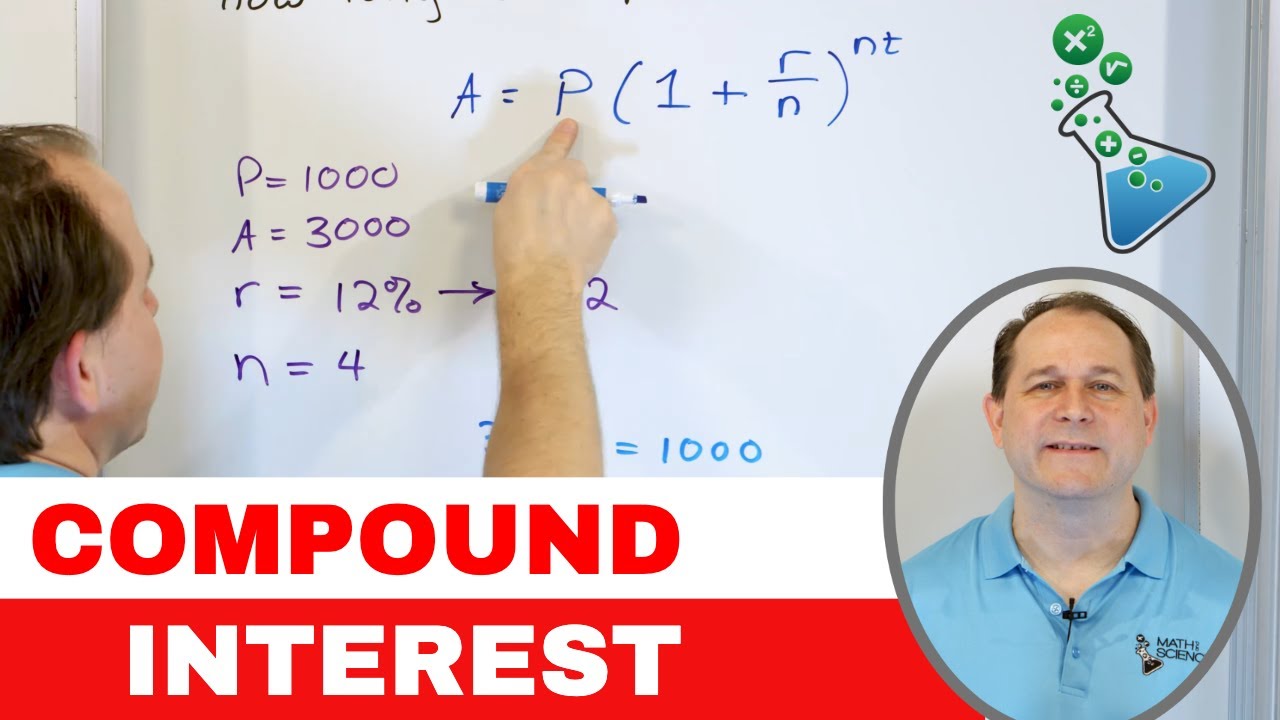

Factors Affecting Fixed Deposit Interest Rates. To compute compound interest we need to follow the below steps. The basic formula for compound interest is as follows.

How is Interest on RD Calculated. Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. To compound interest you multiply the periodic rate by the face amount.

A P1 rn nt.

26 Compound Interest Formula Exponential Growth Of Money Part 1 Calculate Compound Interest Youtube

1

1

Finding Maturity Value Youtube

Simple Interest Calculator I Prt

How To Calculate The Maturity Value Of Fd Compound Interest For An Amount Of 100000 At 6 3 Quarterly Rests Period 666 Days Using A Calculator Quora

3

Maturity Value Formula Calculator Excel Template

Compound Interest Definition Formulas And Solved Examples

Future Value Calculator Basic

Finding Maturity Value And Compound Interest Compounded Annually Number Sense 101 Youtube

Compound Interest Calculator Daily Monthly Yearly

How To Calculate The Maturity Value Of Fd Compound Interest For An Amount Of 100000 At 6 3 Quarterly Rests Period 666 Days Using A Calculator Quora

Maturity Value Formula Calculator Excel Template

Compound Interest Calculator For Daily Monthly Yearly Compounding

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Maturity Value Formula Calculator Excel Template